Smart investors always keep a sharp eye out for what might go wrong, and they build their portfolios accordingly, by not putting all their eggs in one basket.

Today, there are all sorts of things that might go wrong, and there is plenty of bad news to be found everywhere you look. Investors are right to be very worried.

In fact, sovereign bond markets are proof that investors everywhere are extremely concerned, because yields on most sovereign debt are extremely low. 10-yr Treasury yields are a paltry 1.6%; German 10-yr yields are 1.4%; and Japanese 10-yr yields are a mere 0.8%. It's simply amazing that 2-yr German and Swiss yields are now negative. You only buy bonds with extremely low yields like these if you are terribly worried about the risks of other investments. Bottom line, markets everywhere are beset by predictions of doom and gloom.

That's because it's no secret that the Eurozone is in a recession, and that some Eurozone countries seem utterly incapable of coming to terms with their bloated public sector spending, and so the risk of major sovereign debt defaults remains relatively high. It's because the whole world has seen China's economy slow meaningfully, and we know that many developing economies are struggling. Who is unaware that almost every major central bank in the world is up against the "zero boundary," unable to stimulate further by reducing interest rates, and therefore forced to resort to quantitative easing which could potentially threaten a big increase in inflation if not reversed in timely fashion? Iran is getting close to having atomic weapons, and Israel is not the only country worried about the consequences.

Everyone knows that the U.S. unemployment rate, which is still very high at 8.3%, nevertheless severely understates the effective unemployment rate, which is much higher. Nearly everyone bemoans the fact that the U.S. economy has been growing at a very slow rate ever since the recovery started, and that this is the most miserable recovery in our lifetimes.

Pundits remind us every day that there are millions of homeowners who are underwater with their mortgages, and that banks are still holding millions of foreclosed properties (REO) on their balance sheets; thus the "shadow inventory" of properties that could get dumped on the market is huge, and prices could suffer another collapse. So it's no wonder that mortgage rates are extremely low—it's because there is a relative shortage of people willing to borrow to buy homes, even though homes are more affordable now then ever before.

The stock market is studiously ignoring today's extremely strong level of corporate profits, focusing instead on how much profits are likely to decline, which is why PE ratios are below average.

Meanwhile, the U.S. government continues to run trillion-dollar deficits, while the unfunded obligations of social security and medicare are staggeringly large. It's dismaying that there don't seem to be any politicians—with the exception of that right-wing whacko Paul Ryan—willing or able to tackle this challenge. And of course, the "fiscal cliff" looms at year end.

In short, if you don't know that the world is beset with problems and threats of mega proportions, then you just haven't been paying attention. And if you have been paying attention, you're extremely worried about all the things that could wrong, and it's a good bet that your portfolio is extremely conservative. The charts above tell the story: for the past three years, investors have been pulling money out of equity funds and stuffing it into the relatively safety of bond funds, despite the ongoing rise in equity prices. Markets everywhere are depressed because of all the concerns over all the things that might go wrong. Forecasts for future growth range from a depression to, at best, 2.5-3% real growth. Contrarians take note: no one is forecasting growth in excess of 3-4%.

Ok, fine, lots of things could go wrong, but what if something goes right? That, I would submit, is the key risk you face today. Is your portfolio positioned to take advantage of an economy that continues to grow? of a housing market that doesn't collapse again, and in which prices begin to recover, albeit modestly? of corporate profits that fail to collapse?

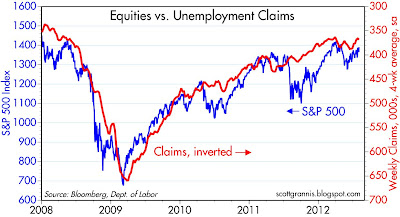

Markets have actually been grappling with these sorts of questions for some time now. As the chart above shows, equities appear to be rising reluctantly, because the economic fundamentals (using first-time claims for unemployment as a proxy) continue to improve instead of deteriorating. When markets are braced for the worst, if the worst doesn't happen, then prices almost have to rise.

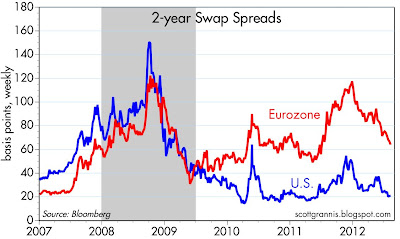

Eurozone swap spreads have improved significantly this year, and 5-yr credit default swaps have declined substantially. Both developments suggest that the risk of a Eurozone collapse has declined meaningfully. Not surprisingly, Eurozone equity markets are up over 16% in the past two months. Not because the future is looking brighter, but because the future is looking less grim.

If just a few things go right, then it is likely that risk assets (in particular equities, real estate, and commodities) could continue to rise in price. And economies could do a little better than expected, even if sovereign yields rise. Indeed, rising sovereign yields would be a sure sign of an improved outlook.

Whereas owning sovereign debt has traditionally been a good way to hedge against the risk of something going wrong with the economy, these days you should consider that being short sovereign debt (or just not holding any, or borrowing at fixed rates) is a good way to hedge against the risk of something going right.

No comments:

Post a Comment