Today's employment report was not encouraging at all—only 103K private sector jobs created, vs. the ADP estimate of 201K—but neither was it cause for increased concern over the health of the economy. The economy is still growing slowly, and it is still way below its growth potential. However, it remains the case that it is improving on the margin, and that is the most important thing at this point, because the market is priced to a deteriorating economy. You can see that in the S&P 500's forward PE ratio of 13.3, which is well below the long-term average PE: the market expects earnings, which are currently close to all-time record highs, to decline significantly. You can also see that in today's 1.6% 10-yr Treasury yield, which only makes sense if one has dismal expectations for future economic growth (think Japan). The market has been expecting another recession, and instead we're getting slow growth, and that's good news in a relative sense.

A few things to note in the above chart of private sector employment: The big gap that opened up between the household and the establishment survey early this year has narrowed significantly. I thought there was a chance that the establishment survey could be telling us that the economy was doing much better than most realized, but now that hope has faded. Judging from these surveys, jobs have been growing at about a 1.2% annualized pace over the past six months, or about 110K per month on average. If the productivity of labor equals its long-run average of 2% per year, then the current pace of jobs growth will give us real growth in the economy of about 3% per year. That's about average, but it will never close the current output gap, which I estimate to be at least 12%. The economy is not going to improve enough before the November election to make a difference.

The only reason the unemployment rate has come down is that there are more than 5 million people who have dropped out of the labor force since 2009.

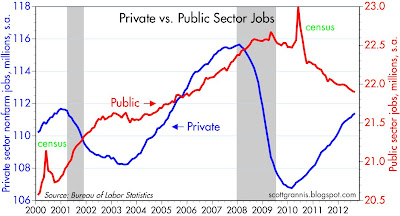

The public sector continues to shrink, but mostly at the state and local level. Mark Perry has some interesting numbers: "From January 2009 to August 2012, there has been a loss of 533,000 local government jobs, a loss of 149,000 state government jobs and a gain of 27,000 federal jobs."

No comments:

Post a Comment