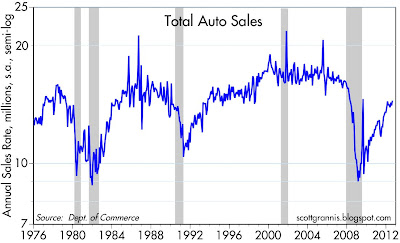

Auto sales continue to rise, and are up at a 14.5% annualized rate since the bottom in February, 2009. This is what a V-shaped recovery looks like, even though sales have still not yet reached their prior highs. With sales consistently beating expectations, the ripple effects throughout the economy are very positive on the margin.

Home builders' stocks are making new post-recession highs. Still far below their prior highs, but moving in the right direction. Lumber prices have doubled since their low in March 2009, further confirming that there is some genuine improvement in the construction sector.

The meme continues: the economy still stinks, but it is getting better on the margin, and things are not nearly as bad today as the market had feared not too long ago. This is what is driving equity prices slowly higher.

No comments:

Post a Comment